*If you read this and think I’m wrong feel free to push-back … I would love to be missing something and have the opportunity to add this again as a long.

Overview

On January 29th of this year, I released a write-up detailing on the reasons I had bought GEE Group, Inc. This opportunity became available for two reasons: mis-understood Q4 results and capital allocation uncertainty. Since then, the company has returned to profitability as I said would happened and activists have responded to management’s negative capital allocation comments with three 13Ds in the stock (as I also said would happen). This has reflected in the performance of the stock which I wrote up at an original price of .47 and sold out today completely at .60. for a 27.7% return or an annualized return of 43%.

Why I Exited

Overview of Price Action: Having invested in and out of this stock for nearly two years not much has changed in terms of what I believe to be the ultimate intrinsic value of the company. I have therefore been very careful in holding the stock as it has gotten into the .60s and .70s as this is much closer to intrinsic value and flips the risk/reward towards the downside. This happened in when the stock got into the .70/.80 range to fall down to .47. A 41.25% loss towards the hands of those highly sensitive to valuation and what you are paying for the distribution of future outcomes. When bad news came post 0.47 cents on capital allocation concerns the stock dropped to around .37 or a 21% dropped. After which you could have purchased at around .40 when the first 13D from Red Oak came out (this was the best time to buy, and I made a huge mistake not putting on an irresponsibly large position here). I believe we are much closer to the negatively skewed risk/return for the following reasons:

Spent forcing mechanisms/catalysts.

Challenging forward labor market environment.

Higher valuation.

Managment M&A challenge.

AI revenue risk.

Spent forcing mechanisms/catalysts: After talking with management a little bit ago it has become very clear to me that the best and what I would say most likely outcome of a strategic review is a tender offer. Management said their goal would not be to sell for a few hundred million dollars and wants to become a billion+ dollar level of company. I think if you surveyed the investor base they would think differently. If forcing mechanism towards making money here is a tender offer at a 10-20% premium with a potentially much higher downside due to points 4/5 I have the inkling the future catalysts may be towards the downside.

Challenging forward labor market environment: The company has already experienced declines in revenue and NOPAT production this year. In the past I have been surprised at how much one bad quarter on accounting nuance surprised investors and am afraid that as the labor market slowly continues to weaken moving forward the potential for a negative surprise may push volume out who wasn’t expecting it. Again, the surprise favors the downside in my opinion.

Higher Valuation: Trading now at a NOPAT Yield of 12-14% on normalized NOPAT of 6-7M I think the stock is much closer to being appropriately priced given the environment it is going to which pressure profits and the risk of management acquiring into a challenged longer-term environment with AI impacting the business and end job markets more and more.

Management M&A Challenge: From my call with management there will likely need to be a proxy fight to get them to sell the company or just run this to terminal value as is. Management is dead set on becoming a billion dollar plus market cap billion dollar plus revenue company. It was this ambission for quick expansion that got the company to almost go bankrupt in 2020. At this price I need to be much more comfortable on the long-term viability of the industry and the M&A prowess of management who historically has moved very fast which I think can come with many issues.

AI Revenue Risk: I think in the longer run (3-5 years) AI could put pressure on revenues by pushing customers to have a much lower need for headhunters in terms of permanent placement. I don’t see scenarios in which that revenue line is not pressured. In addition, for temporary placement revenue being mostly in IT I believe there is risk that there will be redistribution of job needs which could hurt a company that wants to further expand into the industry.

Concluding Thoughts

Overall, I think that at this price the forward catalysts are most likely skewed towards the downside and my ability to discount the future viability of this business has put into question any M&A management does even if it is thoughtful and built out. I am currently re-evaluating the stock to a much deeper level so that I can properly capture future developments and price changes. I think the stock has become much more complex to discount today than a few months ago with the viability of AI coming fully into view and my talk with management. I would further note that I still think this is a decent investment … I however don’t think it is a great one which is my reason for selling.

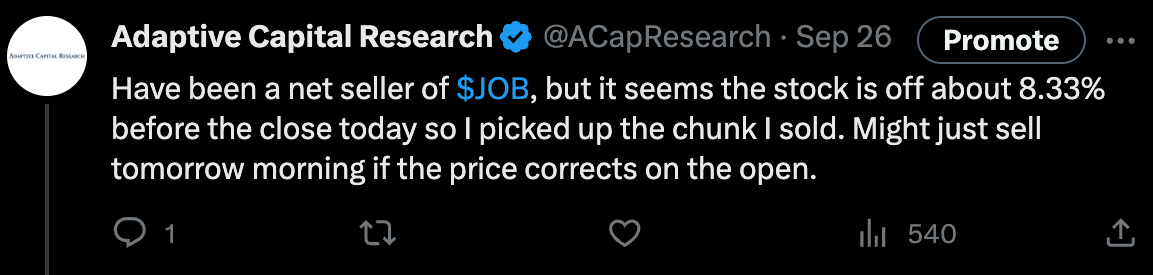

Incremental Information Edge

One edge I think you can build in microcaps and scale up further is knowing something really well and being able to immediately see the future from an incremental fact. From the 13D filed by Red Oak I immediately saw my thesis had played out and I added at a good price. Further with GEE Group I think I’ll have more opportunities to be nimble and act on new information moving forward better than others. For example, just the other day I made a quick ~8% by acting on a price alert which I knew was backed by no filings/news and was end of the day technical selling action.