One Minute Pitch

Gee Group, Inc JOB 0.00%↑ , an employment solutions company, is currently selling for $0.47. The 52-week range is $0.46 to $.80 and the all-time high over the last 10 years was $16.60 on January 2, 2013. I think it is an interesting idea for the following reasons:

Excess cash position of 11-14M (20.4% to 25.96% of market cap) and clean balance sheet cap downside.

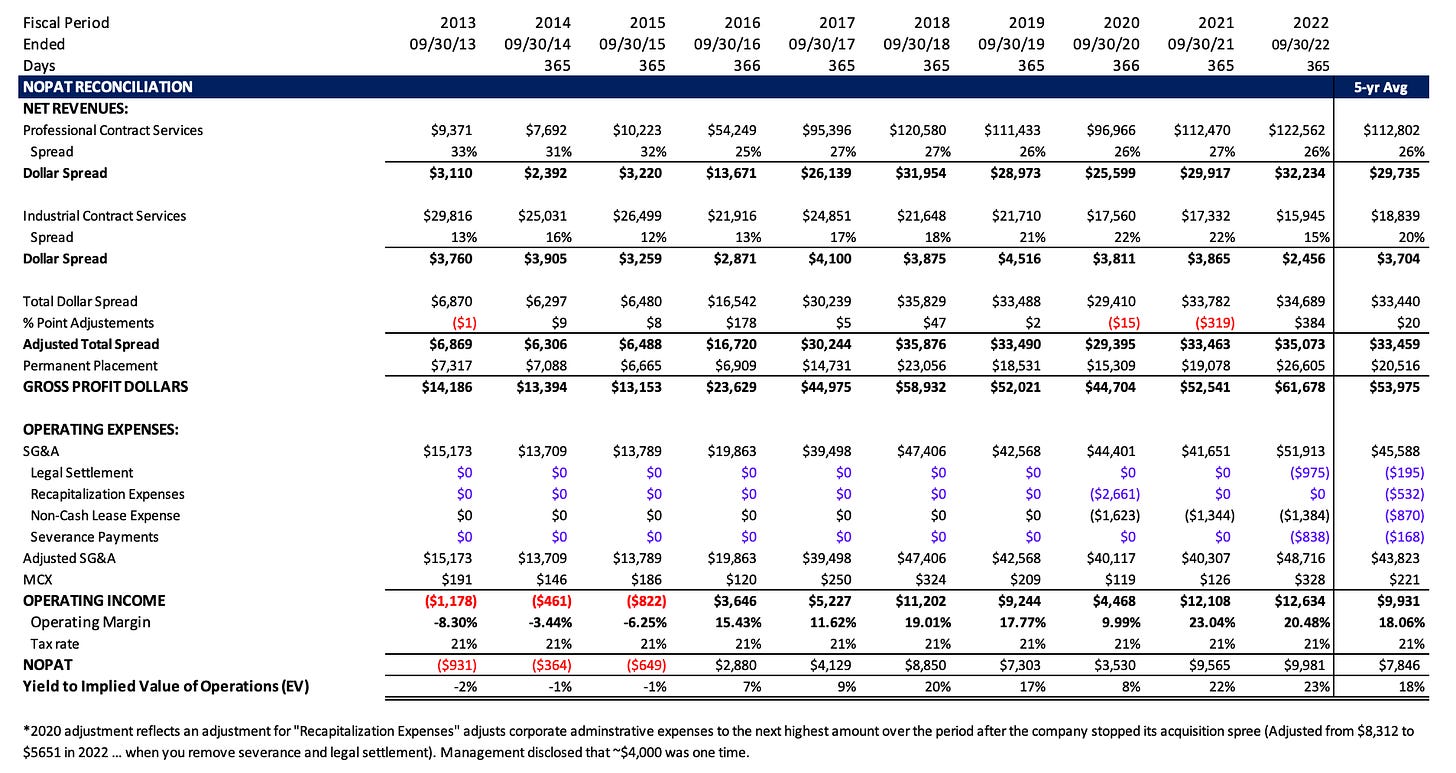

Selling at a 19% 5-Yr Average NOPAT/EV Yield (24% LTM).

Variable cost structure allows the company to stay profitable in downturns (8.43% 2020 NOPAT/EV Yield).

Profitability of the company not fully visible due to previous debt burden, restructuring, and recapitalization costs along with overreaction to Q4 22 earnings have created the opportunity.

Low insider ownership leaves the company ripe for an activist to further add per share value.

I think the company is worth $0.80 to $.85 with further upside from buybacks, consolidation of concentrated office locations, or a potential sale of the company.

Profitability Algorithm

Instead of jumping into the company’s history chronologically, I will first layout a rundown of the companies profitability model and then focus on market expectations and why they are overly bearish towards the company.

Revenue:

At the very top line, we begin with two general models of revenue generation applied across different job verticals: permanent placement staffing & temporary placement staffing.

Permanent placement revenue comes from fees generated as a % of an employees salary when he/she is placed at an employer. Here, revenue is reduced by a provision for refunds as company’s are typically given a 60-90 day window to get a refund if the employee is not a fit. This can be a risk if mass layoffs hit the company’s permanent placement verticals.

Temporary placement revenue comes from a charge/hour worked by temporary employees placed by GEE Group to the end employer.

Cost of Goods Sold:

Cost of goods sold is 100% expense related to cost of temporary employees placed by GEE Group. In additions to wages/hour, this includes payroll tax.

Operating Expenses:

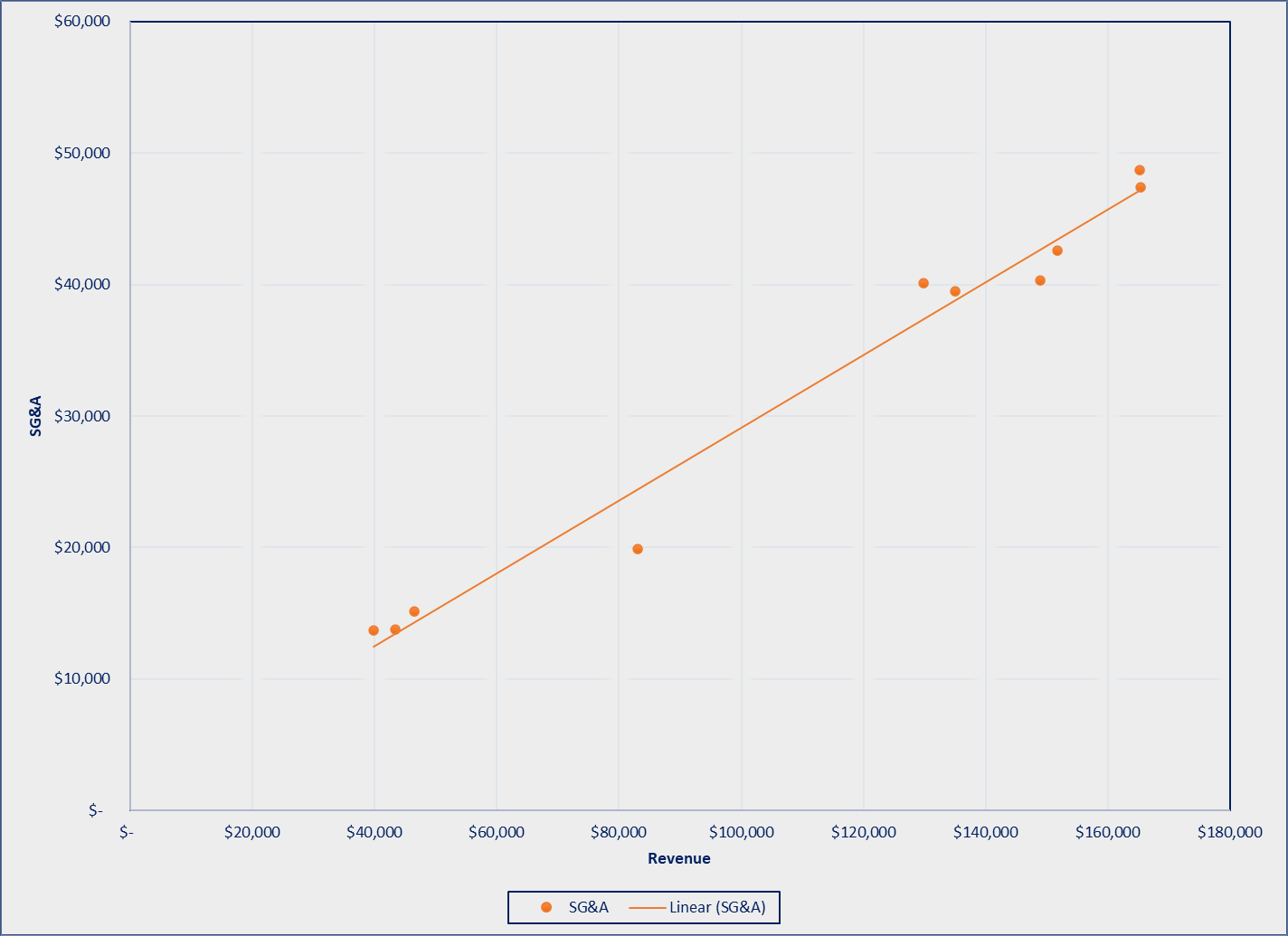

Made up of mainly of SG&A expense which is largely variable towards recruiter/consultant revenues. Aside from being able to control employee count, a portion of employee costs come from incentive compensation for placing employees at permanent/temporary placement spots. As can be seen from the graph below, SG&A is a pretty variable with a correlation value of .8773 and .9895 over the past 5 & 10 years. Fixed cost within SG&A include basic overhead for corporate expenses & to some degree you can only flex the workforce so much during a downturn. It would take a large % decrease for operating leverage to have a big impact and lead to unprofitability. This will be important with current fears of a slowdown in higher in 2023.

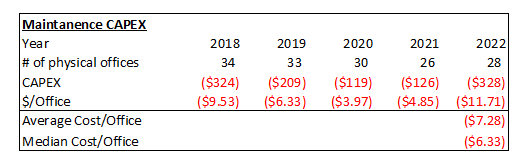

Another important thing to note here are capital & maintenance capital requirements. The company leases all of its offices and has very little in terms of MCX. In terms of tangible capital requirements into the business, you are looking at furniture, computers/hardware, and software in relation towards employee tracking/management, etc. These costs aren’t very high with the last 5 years of CAPEX being very representative of maintenance expenses (company has reduced overall offices & pretty much has had no significant revenue growth/change in the business).

Taxes:

As of 09/30/2023, the company has $17.7M & $14.6M of Federal and State NOL Carryforwards (Valued & Discounted from EV). NOPAT is calculated on constant 21% statutory income tax rate.

Working Capital Needs:

Need for working capital comes from mismatch in client billings & contract employee salary payouts. Management has pointed towards cash requirements for the business being around 3M in 2019 (with higher debt load, not cash flow positive, with some) … although I adjust to 6M for excess cash measurement as that seems as a more reasonable number the company could maintain without having to worry about being tight on cash, etc. Ideally the company would use its cash to buyback stock and finance its receivables with its credit line.

Market Expectations

As seen from the historical financials stated above, forward market expectations are very low for the stock. Since the company refinanced, the company slowly but surely marched closer towards its intrinsic value of $0.80-$0.85, which led me to exit the stock. However the stock is back to being attractive for the following reasons:

Fear of recession/slowing job market & rising interest rates along with disappointing in Q4 2022 earnings.

Concerns over capital allocation/trustworthiness of management.

Q4 Miss & 2023 Recession Fears - Overdone

Running down Q4 results everything looks great until we bump into a 23.37% unexplained increase in SG&A from Q4 2021. If I have told you that the company has a variable operating expense base dominated by SG&A then why did this increase happen if revenue & gross profit dollars were pretty flat ? The answer comes from the Q4 earnings call:

Part of the reason why SG&A was higher in the fourth quarter was because we accrued additional incentive compensation and bonuses commensurate with the outstanding performance that we had put in throughout the remainder of the year. We held off on doing that until the fourth quarter for various practical reasons, but we thought it was prudent to take the full charge for all of that incentive comp.

- Kim D. Thorpe (CFO)

Even while taking the full charge, the company remained profitable … generating 850K in operating income. Within operating income in Q4 I only adjusted for bonuses accrued towards management as I explain above. Further down … I assume that only half of the growth in SG&A QoQ came from bonuses and that the rest is unrelated. This gives us a annualized earnings power yield much higher than a fair discount rate and is yet likely still to conservative.

Moving to 2023 recession fears … I think they are overblown for the company. I am not a macro genius that can forecast what the next 12-18M will look like but my guess is that it won’t be some prolonged 2008 event or even as large of a downturn as 2020. Given I just explained to you why the point in my thesis regarding variable cost structure is intact … I think the company will generate at the minimum NOPAT yields over 8.43% (2020). It is possible that Q1 2023 looks bad as there are an extraordinary number of holidays in the period, but I am comfortable with this as the farther the stock drops in price the more I will buy (given the intrinsic fundamentals of the company don’t change.

Capital Allocation Risk

In an ideal world, there would be a large shareholder over management there to push for acquisitions today and to prevent any future potentially bad acquisitions. However, since this is not the case, we must access the likelihood that management will destroy shareholder value through future M&A and what that might look like if it comes to be. Because I believe this is an important part of the story I am going to try and give a thorough review through answering these prompts:

What did the company look like when Derek Dewan took over on April 1, 2015 ?

A run-down of each acquisition the company did over the proceeding years.

What is the likelihood that management begins an M&A spree with the company at these low valuations ?

What could the company be worth under that scenario ?

Starting Point

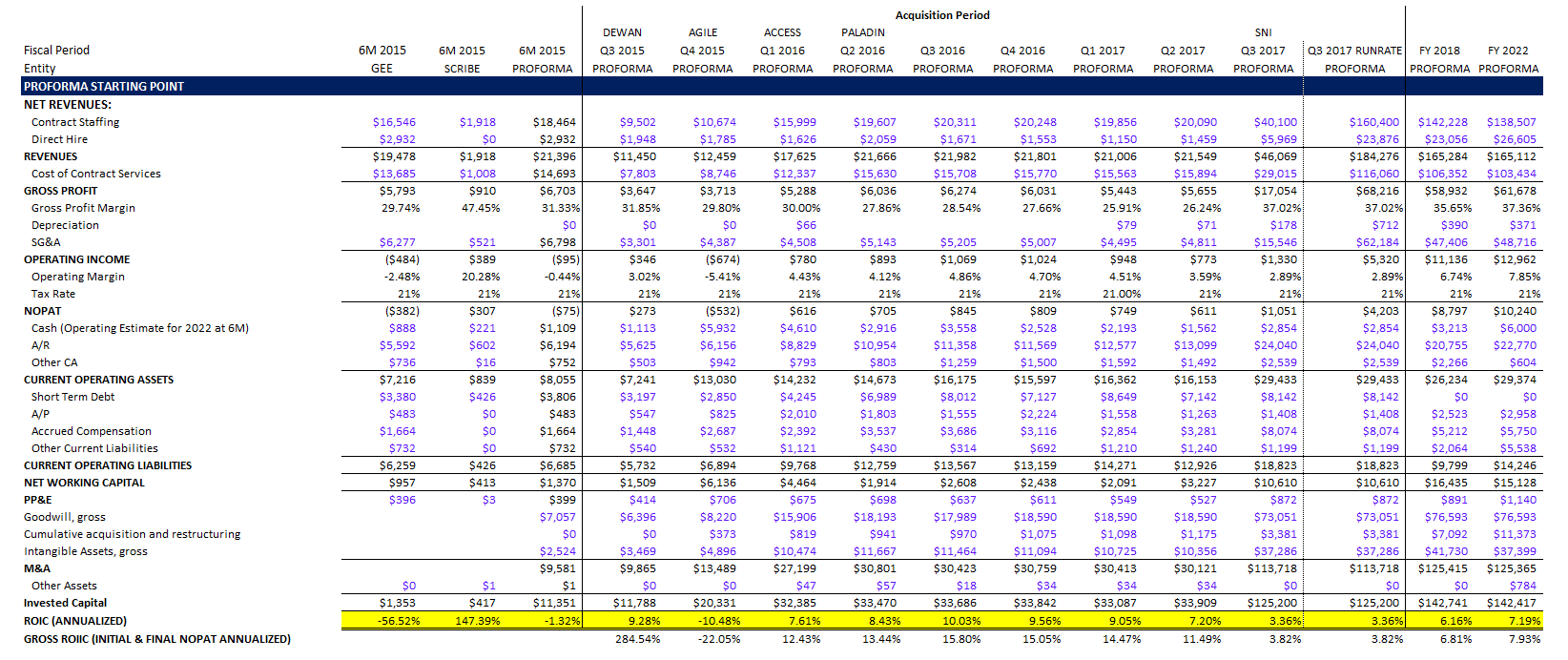

On April 1, 2015 the merger between GEE Group and Scribe solutions went through and so began the Derek Dewan era. Coming in the company was not on solid footing as can be seen from the pro-forma below:

(May have to open full picture to see well, used depreciation instead of capex so numbers may slightly differ to those above)

At that point the company was mainly composed of its current industrial segment and had little revenue coming from professional (temp or perm). If the company were to go on another acquisition spree today, it would be starting out at a much better point and would find it much easier to find reasonably priced debt which we will see was something that was not done over the 2015-2017 period.

So Begins M&A

While it is true that in total M&A creates value … it is also true that most of that value goes to the target as M&A for acquirers is value destructive more often than not. Management clearly believed and still believe they can create value from M&A:

The SNI acquisition was challenging, but I still tell people and believe that it's the best acquisition we did. The execution was a little clumsy, but we got there. And we now have a company that's worth way more than it was at the outset. This whole team has a lot of experience in acquiring companies. I get the point, or I see the metric, 60% to 70% destroy value. That's not the case here. It wasn't the case at MPS Group when Derek and our board led that business. So, just stay tuned.

- Kim Thorpe (CFO)

Q3 2015 - No acquisition activity to this point Dewan comes in and brings the company to profitability raising ROIC to 2.32% from the previous quarter.

Q4 2015 - GEE Group acquires Agile Resources (4M consideration), Inc.

Q1 2016 - GEE Group acquires Access Data Consulting (21M Revenue, 2.5M EBITDA for FY2014, 15M consideration).

Q2 2016 - GEE Group acquires Paladin.

Q3 2017 - GEE Group acquires SNI.

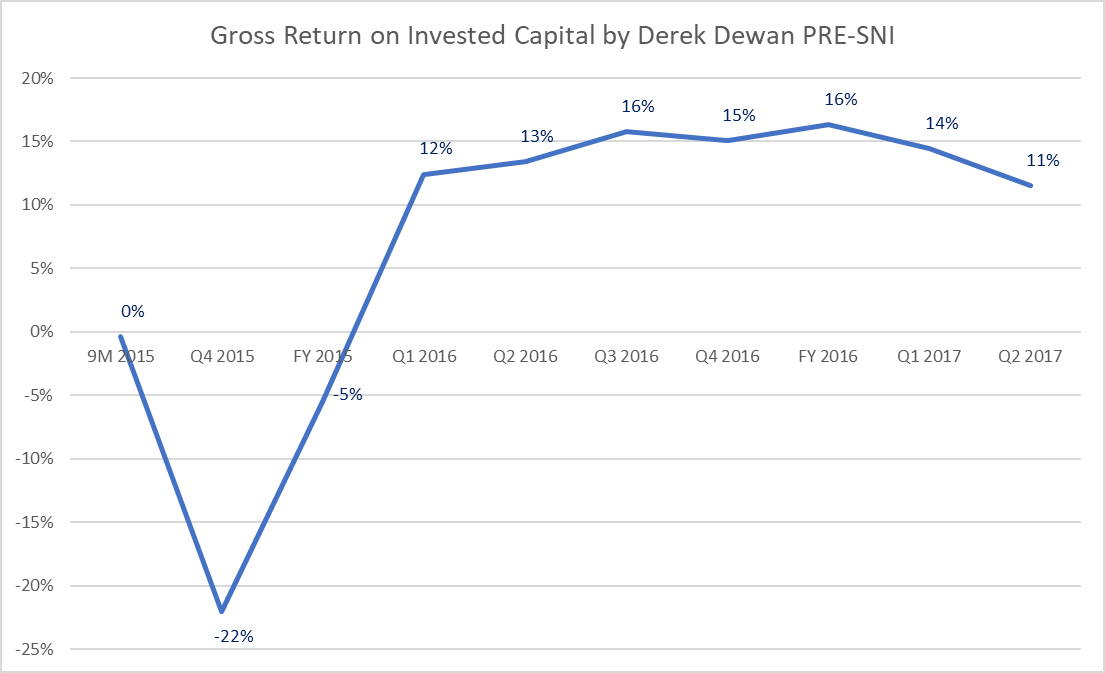

To be honest, I heard the management/other investors story that it was the SNI acquisition that toppled things over, but I never believed it. In the process of writing this though, I decided to see what ROIC invested during Dewan’s tenure were and was pretty surprised to find out that pre SNI ROIIC was actually near/above the a reasonable discount rate.

Post SNI ROIIC dropped dow to 3.82% during Dewan’s tenure and has slowly recovered to 7.19% as the company has restructured to assimilate huge SNI acquisition over the following years. It is important to note that the biggest killer of the company was the debt it had to take for these acquisitions and the rates it had to take it at with 16% peak rates (11% cash + PIK). The SNI acquisition HAD to work out for the company to have moved forward & not having to refinance … there was no room for a multi-year restructuring.

Overall, I was expecting to see a lot worse here and actually gives me a small hope that management could generate shareholder value from M&A if they go for the bolt-on acquisitions they have pointed to wanting to do in the future.

Will they acquire at these valuations ?

Here I feel quite well with the fact that management will not go with anything stupid at these valuations.

If management wants to expand quickly, they know they will have to use stock to some degree. Even if they don’t seem to be using a perfect economically viable model for analyzing targets, even the accretive to earnings model they use will make it hard for them to find something that will be accretive at current prices.

Management has acknowledged that the given the stock’s valuation, it will be hard to find a good M&A target.

The answer to your question is, regarding acquisitions versus share buybacks and use of cash, share buybacks at this level are attractive because we are undervalued as a company and the stock price represents a great value. Alternatively, the appropriate acquisitions that you don't overpay for, particularly when you're trading at 4.5 times roughly EBITDA, if you could price those right and have it appropriately neutral or accretive to earnings, that makes some sense. However, share buybacks, particularly with our balance sheet, at this point, are definitely under consideration. We said that before. We actually have more than $14 million in cash at this point in an unused credit facility.

- Derek Dewan (CEO) Q2 Earnings

In 2015 Dewan had a higher % ownership of the company & was coming in fresh … likely could have defended an activist position. If you listen to the company’s calls today, the company could not hold of an activist today with sub 5% insider ownership.

If they acquire, will it turn out better ?

And I agree with that comment completely. And let me lay any concerns that shareholders would have. We are not going to overleverage this company. We are not going to have high interest rate debt. And we got out of that situation, and we will never get into that situation again. So, you can take that to the bank. Kim, we've had that discussion several times. We do believe our shares are a tremendous value. And at the appropriate time, we'll address what the first question dealt with in terms of share buybacks.

Turning – let's see, the next question here. Another question was, your $1 billion goal in 2025 – I'll shorten that – is that an ambitious goal? And should you do smaller acquisitions essentially and/or buy back stock or both? What's management thinking about that?

So, I can tell you that the large acquisition of size would not be attractive to us if we had to use significant leverage or high interest rate debt. What's more likely are smaller tuck-in acquisitions that are highly profitable and that we use a combination of seller financing, cash, and our credit facility, our ABL if necessary, which is priced at LIBOR plus couple hundred basis points. So, I wouldn't be too concerned about a large acquisition in the near term.

- Derek Dewan (CEO) Q2 2022 Earnings

The above comments give me hope that management has somewhat changed its acquisition strategy moving forward to buying smaller targets. That along with the fact that the company should be able to obtain better financing & has built a structure to better integrate targets in the future (pointed out by Kim Thorpe in one of the calls). Further, management did decent before the SNI acquisition and has overall achieved a ~8% return on the capital it has invested as of 2022 results.

Activism

While I have come out of this pleasantly surprised that management actually did better than I originally underwrote in terms of M&A I still believe there is space for someone to come in, check management on their capital allocation, engage in a buyback … and to double its investment in 2023.

*This is only my second write-up since Thungela so feedback is welcome. Got this out pretty quickly so I apologize if the post is not as easy flowing as could be.

*This is not at all constitute investment advice, I am not a professional, I have never charged a fee for managing money, I am not registred with the SEC or any other significant regulatory organization, do your own due dilligence.

What are your thoughts on GEE today with announcement of the buyback and activist investor Red Oak now in the picture? Cheap on forward multiples as well...As long as job market holds up decently well (and so far it has relative to other recessions/periods of economic weakness) seems like a compelling r/r. Wonder what I am missing though or should be fearful of...like what could go wrong? any thoughts!?